- Get link

- X

- Other Apps

Imagine living in a world where filing an insurance claim takes mere minutes, policy adjustments occur instantly, and personalized coverage meets your real-time needs seamlessly – the rapid digital transformation in insurance is already creating this reality. Did you know global InsurTech investments hit $13.5 billion last year alone, signaling an astounding shift in how insurance is conducted globally? This increase underscores technology’s undeniable effect on an industry traditionally associated with manual processes and lengthy procedures – at its heart lies digital transformation for insurance.

At its heart, InsurTech (an amalgamation of “insurance” and “technology”) is disrupting traditional insurance models through cutting-edge technologies like AI, big data analytics, and mobile apps. InsurTech solutions aim to streamline operations while improving customer experiences and creating innovative insurance products; its growth has driven increased demand for robust Insurance app development

– serving as one of its cornerstones of transformation.

This blog seeks to walk you through the fundamentals of building insurance applications that effectively exploit InsurTech benefits. We will explore key features, best practices, and strategic approaches necessary for designing apps that meet and exceed customer expectations and touch upon InsurTech’s future prospects.

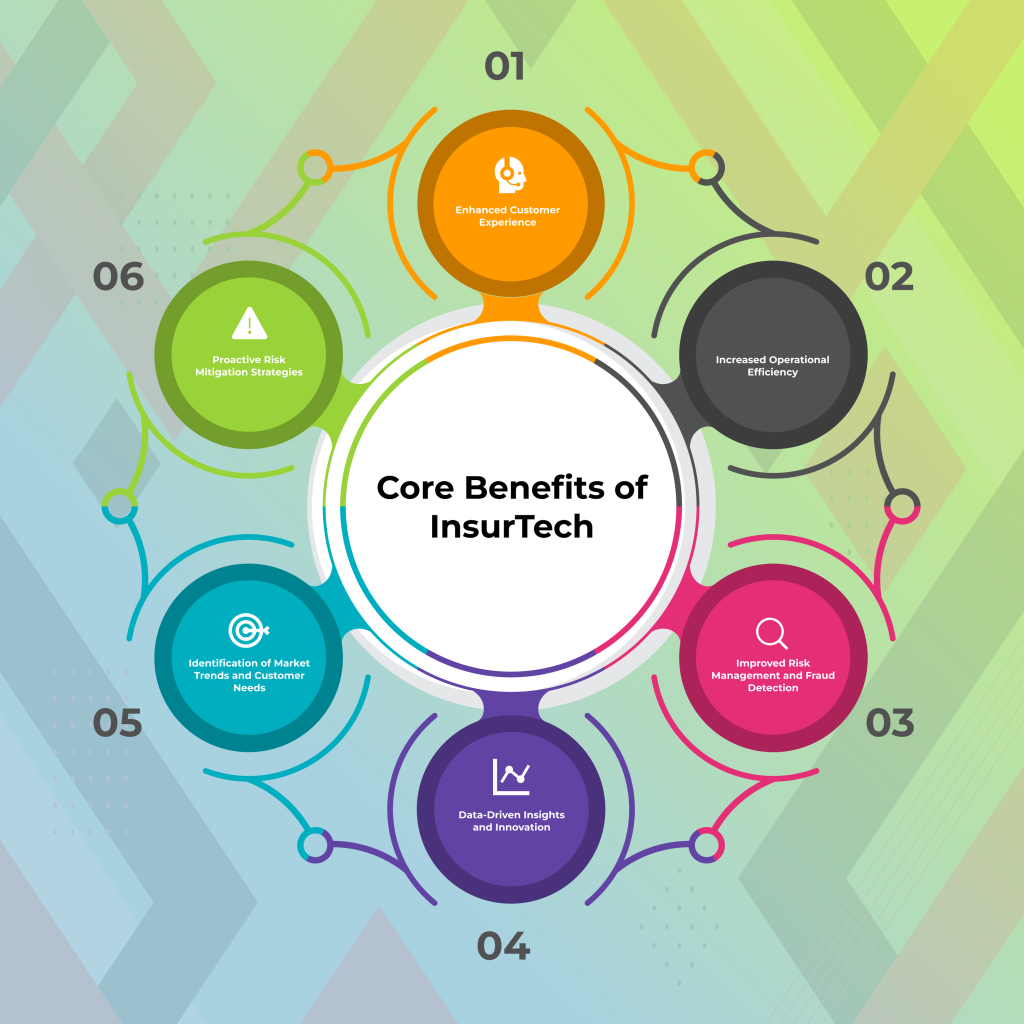

Top Benefits of Using InsurTech in Insurance Apps

Enhanced Customer Experience

One of the most significant advantages of incorporating InsurTech into insurance apps is improving customer experiences dramatically. Insurance providers can transform customer experiences with AI-powered chatbots, real-time policy updates, and simplified claims processes, providing seamless journeys tailored to individual consumers. Customers enjoy immediate access to policy details, claim submissions, and personalized recommendations based on individual needs. These innovative approaches to personalizing insurance experiences foster trust and loyalty between customers and insurers, turning a potentially cumbersome expertise into a user-friendly and efficient digital interaction. InsurTech empowers customers by giving them control and transparency so insurance becomes less complicated and daunting for everyone involved.

Increased Operational Efficiency

InsurTech solutions in insurance apps streamline multiple operational processes and increase efficiency significantly, thanks to automation, which eliminates manual data entry and paperwork processes, resulting in greater productivity and decreased errors while increasing workflow speed.

AI in insurance apps can automate policy underwriting, claims processing, and customer support tasks, allowing human resources to focus more closely on complex and strategic initiatives. Not only will insurers lower operational costs with this strategy, but response times will also benefit significantly, allowing for faster handling of customer transactions and inquiries and resulting in leaner, more agile operations that can quickly adapt to shifting market requirements.

Improved Risk Management and Fraud Detection

InsurTech significantly boosts risk management and fraud detection capabilities within insurance apps by harnessing big data analytics and machine learning techniques to analyze large amounts of information to detect patterns that indicate fraudulent activity. Real-time monitoring and predictive analytics allow proactive risk evaluation, helping prevent fraud before it happens.

IoT integration facilitates real-time data collection that can be used more accurately to assess risk assessments and create customized policies based on actual usage or behavior data collected during monitoring sessions. Taking this data-driven approach decreases financial losses related to fraud and leads to fairer policy pricing practices by offering more precise risk evaluation processes and pricing structures.

Data-Driven Insights and Innovation

Integrating InsurTech into insurance apps unlocks many data-driven insights, fueling innovation and strategic decision-making. Through analysis of customer behavior, claims data, and market trends, insurers gain greater insights into customers’ lives and the industry landscape. Using this insight, insurers are better equipped to develop new insurance products, personalize marketing campaigns, optimize pricing strategies, identify risks/opportunities early, stay ahead of their competition while meeting evolving customer needs, as well as foster an environment of continuous improvement/innovative thinking throughout their business – driving the industry forward.

Identification of Market Trends and Customer Needs

InsurTech allows insurance apps to analyze market trends and customer needs continuously. Insurers gain real-time insights into changing customer preferences and market dynamics by employing data analytics and customer feedback mechanisms. This allows timely identification of emerging trends that enable insurers to adapt products/services accordingly to meet demands as they arise.

By monitoring user activity within an app, insurers can identify customer pain points/preferences, leading to tailored and more relevant offerings from insurance providers who remain responsive and competitive as customer needs evolve.

This proactive approach to market analysis ensures insurance providers remain responsive in meeting evolving customer demands while remaining responsive in meeting evolving demands from their clients as customers changing demands by customer demand analysis techniques ensuring proactive approach insurance providers remain responsive in meeting changing demands from their clients while remaining responsive in meeting needs changes by keeping up-to-date.

Proactive Risk Mitigation Strategies

InsurTech technology enables insurance apps to employ proactive risk mitigation strategies, significantly decreasing potential losses while improving overall risk management. By harnessing IoT in insurance technology

and real-time data, insurers can monitor and assess risks in real-time for immediate intervention and prevention measures.

Telematics data can also help auto insurance providers detect risky driving behavior and offer personalized feedback to drivers to reduce accidents. Sensors used in property insurance can detect potential hazards such as leaks and fires in real time and act swiftly to address them, helping minimize risks while encouraging proactive prevention for safer results for both insurers and customers alike.

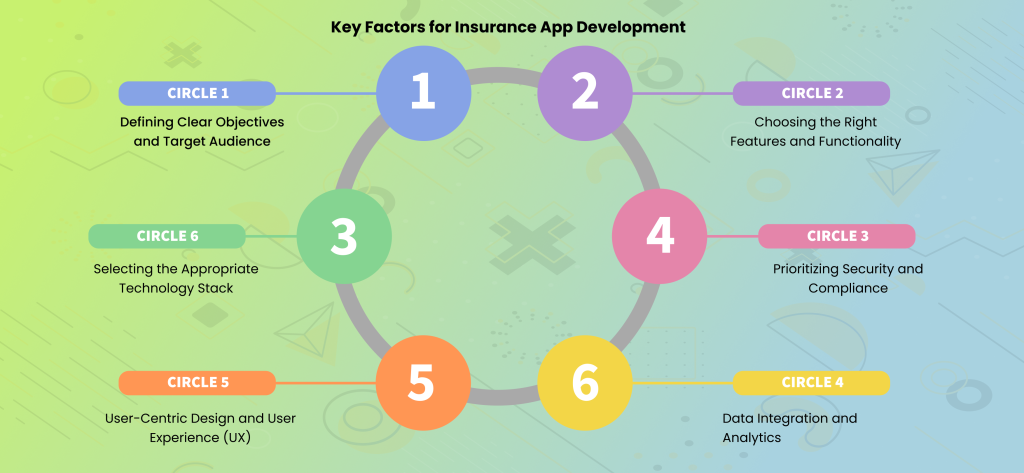

Key Elements for a Robust Insurance App Development Approach

Here are the key elements for an efficient insurance app development approach:

Defining Clear Objectives and Target Audience

As with any successful product or service, an insurance app’s success hinges on articulated objectives and an in-depth knowledge of its target audience. Before writing code, it’s essential to identify its purpose: what problems does the app aim to solve or address directly? Defining demographics, technological proficiency levels, and pain points of users helps shape its features and design for greater user relevance and higher adoption rates/customer satisfaction, resulting in improved customer experience. A well-organized strategy with clearly established objectives and target audience research acts like an inner compass throughout the development processes, ensuring success.

Choosing the Right Features and Functionality

Selecting features and functionality essential to creating an efficient insurance app. This involves finding an equilibrium between essential functionality and innovative features that give it a competitive edge. Start by prioritizing core features like policy management, claims processing, and customer support before adding advanced functionalities like real-time policy updates, personalized recommendations, or chatbots powered by AI technology.

Features should align with defined objectives and address specific audience needs while remaining user-friendly for maximum satisfaction and engagement. A carefully curated feature set ensures an app that’s powerful and user-friendly, guaranteeing user engagement and satisfaction with every purchase.

Selecting the Appropriate Technology Stack

Technology stack selection is essential to app development success, and choosing an ideal stack is crucial to its performance, scalability, and security. When making this decision, consideration must be given to factors like platform compatibility between iOS, Android, and web platforms; development frameworks; databases and cloud-based insurance software; and integrated security features.

You should opt for flexible future growth with encryption protection measures integrated directly into each chosen technology stack as well as their capacity for scaling with increasing user loads or data volumes – not only will a well-curated stack ensure a smooth development process, but it will set a foundation for reliable and efficient apps in terms of reliability.

Prioritize Security and Compliance

A secure payment gateway for insurance apps is paramount, particularly when handling personal and financial data. Implementing reliable measures, such as encryption, multifactor authentication, and regular audits, is necessary for safeguarding user data against breaches while adhering to relevant regulations like GDPR, HIPAA, or industry-specific standards is also key to avoiding legal penalties while keeping user trust intact – ensure your development process includes comprehensive security testing and compliance checks during its creation; prioritizing these practices not only protects customer data but builds an aura of trustworthiness and reliability among its users.

User-Centric Design and User Experience (UX)

User-centric design and an excellent user experience (UX) are crucial elements to the success of an insurance app. When developing user interfaces that streamline complex processes, perform extensive user research and testing to learn user needs and preferences, prioritize mobile-first design for optimized screen sizes/device compatibility, and incorporate feedback loops for continuous UX improvements, ultimately, this approach increases engagement, satisfaction, retention rates resulting in app success.

Data Integration and Analytics Solutions

Data integration and analytics are vital to unlocking valuable insights and optimizing app performance. Integrate data from disparate sources like policy databases, claims systems, and customer feedback platforms seamlessly while using advanced analytics tools to track user behaviors, identify trends, and measure key performance indicators (KPIs).

Use insights drawn from your analytics data to personalize user experiences by streamlining claims processing or improving risk evaluation while making analytics work for you by pinpointing areas for improvement within an app’s functionality – data integration empowers insurers with informed decisions as they drive innovation while offering more personalized and efficient service delivery capabilities to their clients – helping insurers innovate while simultaneously increasing service quality over time.

Conclusion

When executed strategically, Insurance app development can bring many advantages: improved customer experiences through personalization and convenience, operational efficiencies gained through automating processes, advanced analytics for risk and fraud detection purposes, and data-driven insights that boost innovation are just some potential outcomes. Given how quickly technology evolves today, taking advantage of InsurTech offerings now will position providers to meet consumer expectations as they remain ahead of the competition while remaining ahead.

As we look ahead, the future of InsurTech seems bright. As technology progresses further, more AI, IoT, and blockchain integration should allow for personalized, predictive, and secure insurance experiences – with embedded insurance or micro-insurance increasing accessibility even further – micro-insurance could even make insurance accessible to a broader range of people than before. As technology develops, insurance apps will become even more integral parts of this evolving industry – driving innovation while shaping its path into the future of insurance itself.

Are you looking to launch an InsurTech app development project or realize its full potential? Echoinnovate IT can assist!

- Get link

- X

- Other Apps

Comments

Post a Comment